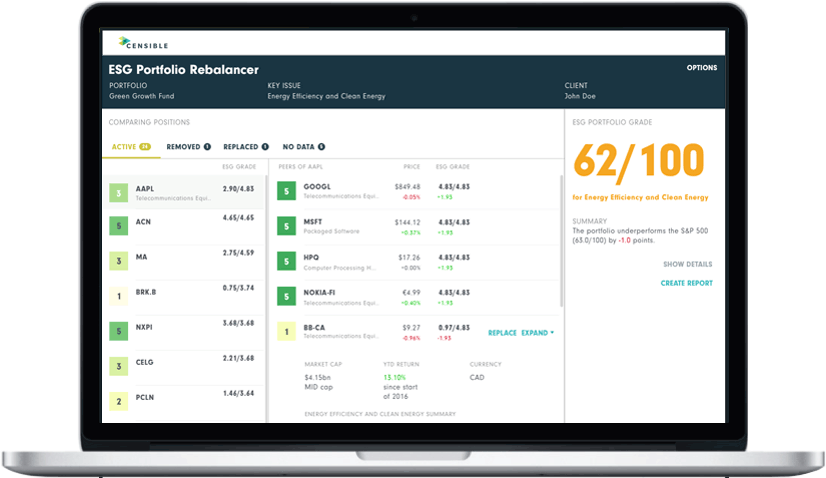

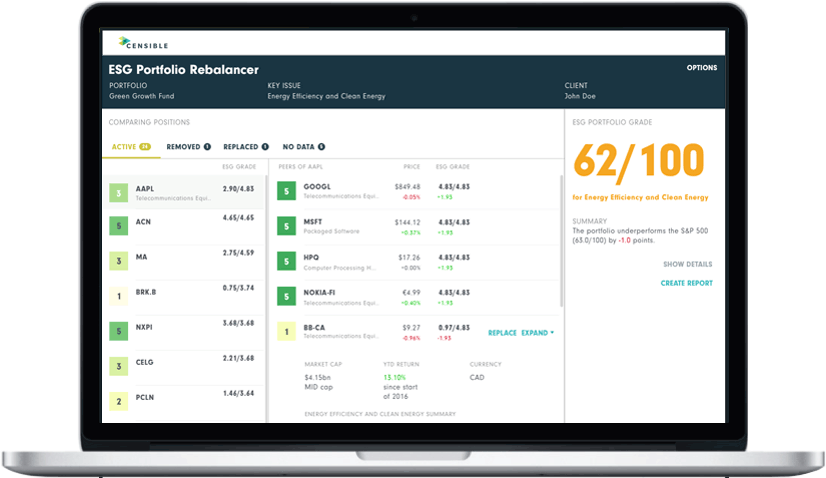

ESG Portfolio Tools

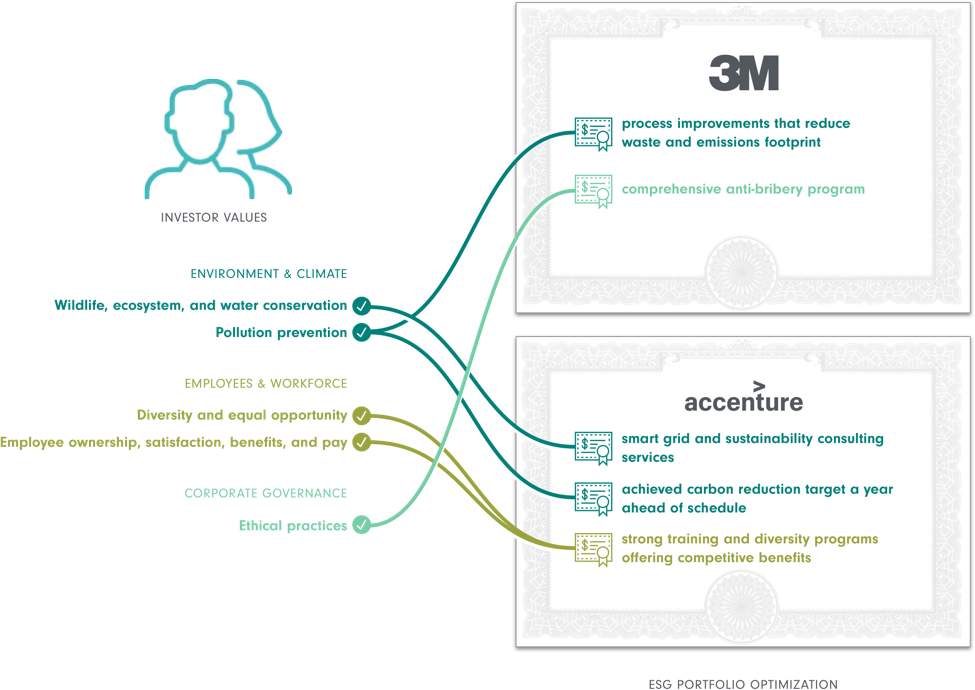

Analyze and design investment strategies through the prism of your clients' values. Add new dimensions to your risk assessment capabilities and find new opportunities.

Censible aggregates millions of Environmental Social and Governance (ESG) data points to measure how stocks, mutual funds and ETFs perform on issues like carbon emissions or gender diversity.

Our solutions integrate seamlessly with your existing investment processes so you can provide your clients with a high-tech ESG service.

Analyze and design investment strategies through the prism of your clients' values. Add new dimensions to your risk assessment capabilities and find new opportunities.

Generate tailored reports for each client based on specific institutional mandates, guidelines or individualized ESG objectives.

Research shows that over time, companies that prioritize social responsibility may significantly outperform companies that don’t.

ESG data can help fill in the gaps that are left out by financial analysis alone. By analyzing ESG data, you can learn more about how a company is managed, how prepared they are for risks, and how they are planning for their future.

A company’s performance in this category is based on its success in implementing energy efficiency measures and reducing its carbon footprint. Investments in energy efficient technology, green building and sourcing of renewable energy can all lead to cost savings and reduce the company’s contribution to climate change.

Employers that are rated as good to work for consistently produce higher stock returns than their peers. Any combination of benefits aimed at improving the lives of employees can improve employee morale and reduce employee turnover. These could include profit sharing, equity-based compensation plans, paid family leave and vacation time, gym memberships for employees and onsite childcare, among any number of benefits. Companies that have tensions with labor, high likelihood of labor disputes will not score as well in this category. On the other hand, companies with policies and practices in place that will help them to attract and retain talent will perform well in this category.

Companies that are expanding markets for organic food, reduced fat, sugar, and sodium and food and beverages with fewer artificial and controversial ingredients perform well in this category.

Illegal, hazardous and harmful work conditions for children or work that prevents children from attending school constitute child labor. Child labor is often connected to abuse, child slavery, child trafficking, forced labor and other exploitive activities. Companies will rate well on child labor issues if they take precautions to reduce and eliminate child labor risks in their supply chains.

How a company treats its customers may reflect on company values and culture. Companies that score well in this value have a track record of being responsive to customer needs, treating customers fairly and setting fair prices and terms for the sale of goods and services. Companies who meet and exceed customer expectations will score well in this category.

A company’s rating in this category depends on the extent to which it is transparent in disclosing risks and opportunities connected to environmental, social and corporate governance factors. Reporting on environmental, social and corporate governance data is understood more and more as a financial risk that reflects on a company’s bottom line. There are several standardized reporting standards and specific disclosures that many publicly traded companies utilize for environmental, social and corporate governance (ESG) reporting. There are a handful of disclosures required by the Securities and Exchange Commission related to these issues; however, the vast majority of company reporting on this information is voluntary, utilizing standards like the Global Reporting Index (GRI), Sustainability Accounting Standards Board (SASB), CDP or the International Integrated Reporting Council (IIRC).

Certain industries and companies sell products that have risks for injury, contamination and even food poisoning. These product liability risks include controversies like an E.coli outbreak or a recall of cars with failing airbags. Companies that score well in this category manage product safely effectively.

Certain products use raw materials that are commonly sourced from militias or other organizations that promote or engage in conflict in their region. The Dodd-Frank Act now requires that companies disclose use of the conflict minerals, such as gold, tin, tantalum and tungsten that are necessary for production and functionality. To perform well in this category companies must provide adequate assurances that any of these metals used in their production are in fact from conflict-free sources.

Corporations that perform well in this value contribute to the communities they do business in through philanthropy, working with schools, sponsoring community activities and involving local communities in corporate decisions that will impact them.

A history of controversies related to unethical corporate behavior will reduce a company’s rating under this value. Companies who make false claims about their products, engage in price fixing, or have a history of executive misconduct, insider trading or fraudulent practices can have an adverse impact on the market, customers and communities they work in.

Corporate human rights abuses often come in the form of forced labor and hazardous work conditions for outsourced labor, but can also result from impacts to communities from corporate-caused events, such as an oil spill that covers a community in oil and destroys the livelihoods of the people impacted. The United Nations Human Rights Council established Guiding Principles on Business and Human Rights. Companies that follow the UN Principles perform better in this category.

Censible evaluates the sourcing of raw materials, water impacts, ecosystem impacts, and overall impact on natural systems and biodiversity to rate companies on this value. A company’s success in eliminating, minimizing and mitigating any harm it inflicts upon ecologically valuable habitat will improve its rating on this value. Some industries or companies are likely to operate in locations with sensitive biodiversity. Companies that proactively implement measures to minimize impacts to stressed or drought prone water resources and utilize water saving and reuse technologies perform well in this category.

The number of accidents and injuries in the workplace can be an indicator of whether an employer is taking sufficient steps to create a safe work environment. Companies improve their performance on this value through investing in equipment and factories that reduce the risk for incidents. Training employees on safety issues and implementing ergonomic initiatives can accomplish this. While some accidents may be inevitable, the infrastructure, policies and practices in place can significantly reduce the risk for safety incidents in the workplace.

Companies that perform well in this category have effective systems, products and procedures in place to minimize the risk for data and privacy breaches. Companies today digitally manage vast amounts of personal information about their clients, including social security numbers, credit card numbers, bank information and health records. The security system that a company has in place to protect sensitive personal information is critical to minimizing risks to customers for financial harm and privacy breaches. A major data breach can lead to significant reputational harm or financial loss for the companies holding such data.

Companies that reduce their waste footprint (including hazardous wastes), effectively recover and recycle products, and develop products that reduce human and environmental exposure to pollution score well in this value. Smog in the air, fertilizer causing algal blooms in surface water and toxic and carcinogenic pollution can all negatively impact public health and the environment.

Companies with policies and practices that are inclusive, supportive and ensure equal opportunity to the LGBTQ community, women and minorities will rate higher in this category. Factors considered include whether women, minorities and LGBTQ individuals are sufficiently represented in management positions and on the board of directors and if policies and practices are in place that protect these groups from discrimination.

The extent to which a company follows best practices with respect to accounting practices, executive pay, board organization and ownership structure influences its score in this category. Certain risks can reduce a company’s Corporate Governance rating. These include: Dubious accounting practices, certain executive pay schemes, whether the board of directors is independent of management, qualified and is not over-extended through participation on too many boards, how executive pay compares to peers, whether pay is aligned with performance and practices regarding company equity. The ownership structure of a company, shareholder rights, majority voting provisions and whether there is a controlling shareholder block are all considered under Corporate Governance. With respect to accounting practices, we consider incidents of accounting investigations, fines, settlements, convictions or late filings.

Learn more about how we use ESG data.

Email us at [email protected] to learn more about our solutions and partnership opportunities.